Imagine you are trying to eat healthier and diligently logging your meals into a calorie tracking application. Or perhaps you are tackling a brain teaser puzzle online, aiming to sharpen your mind. In these situations, no one is checking up on you, and there are no prizes or punishments from an external source.

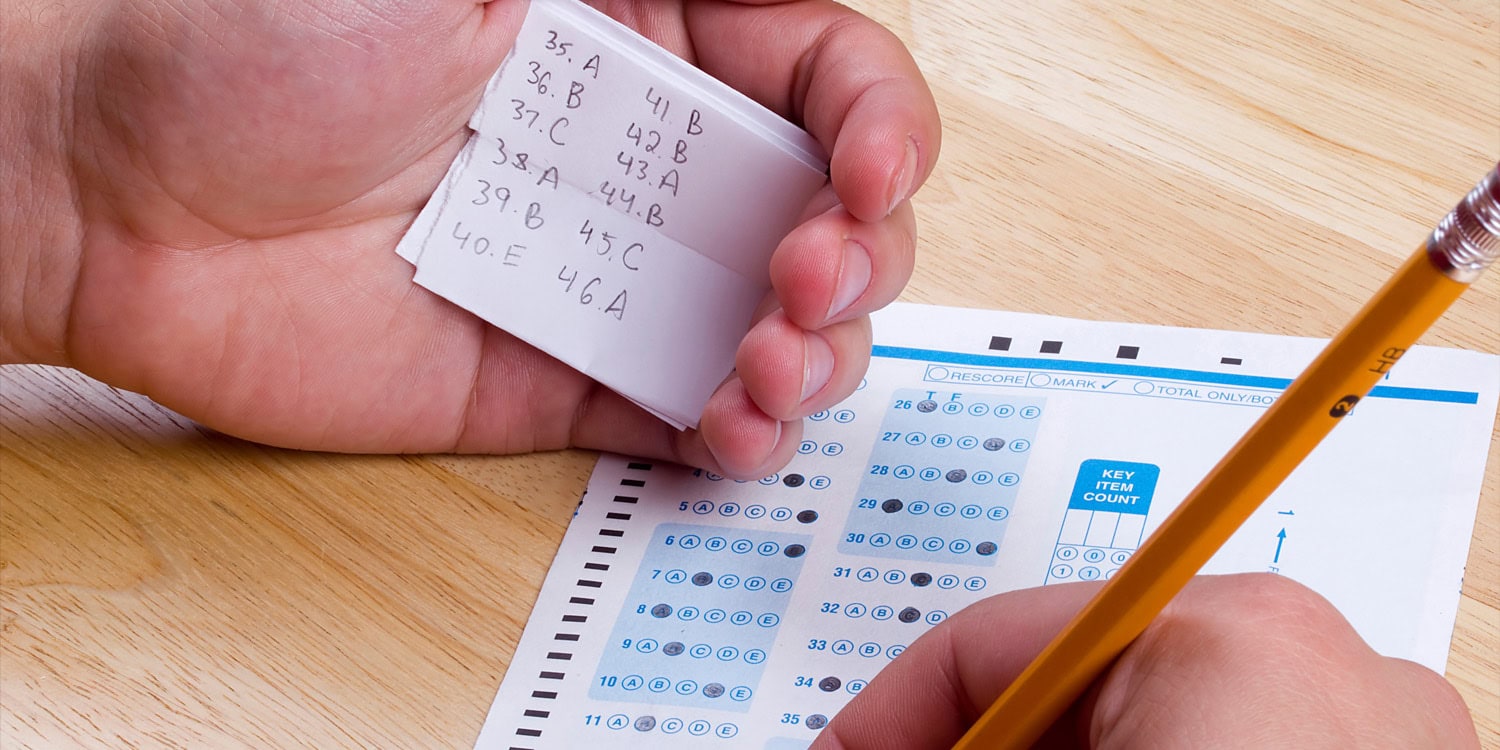

Yet, a new study published in the Journal of the Association for Consumer Research reveals that people are still likely to cheat, even when the only reward is the internal feeling of being healthier or smarter. This research shows that individuals deceive themselves into believing they are genuinely improving, even when their progress is built on dishonesty.

Sara Loughran Dommer, a marketing professor at Penn State University, spearheaded this research because she was curious about a particular type of everyday dishonesty. We know that people sometimes cheat to get ahead in business or to gain material possessions. For example, some shoppers buy clothes, wear them once, and then return them for a full refund. Others misuse discount codes or lie to get money back from companies. However, Dommer noticed that people also seem to cheat in situations where the benefits are not about money or possessions, but about how they see themselves.

“I was curious as to why people (including myself!) cheat at crossword puzzles, Wordle, etc,” Dommer explained. “Cheating for better grades, awards, and money makes sense; we want these extrinsic rewards. But why do we need to complete the crossword puzzle? My intuition said, we must get some sort of benefit from it (e.g., we feel smarter). But then I thought, how could we possibly reap any kind of benefit if we know that we cheated? I shouldn’t feel smarter because I needed to cheat to complete it. That piqued my interest.”

To explore this phenomenon, Dommer designed a series of four studies. In each study, participants were given tasks where they had the opportunity to cheat to potentially boost their self-image in some way.

The first study focused on calorie counting and involved 379 undergraduate students from a large public university. These students participated in lab studies and received extra credit for their time. The study was designed with two groups. One group received detailed calorie information for hypothetical meals they were asked to imagine consuming over three days. The other group did not receive this specific calorie information.

All participants were then shown a list of five calorie options, similar to what a calorie tracking application might provide, and asked to log the calorie intake for each meal across three days. The idea was that those without precise calorie information might be more tempted to cheat by selecting lower calorie options, even if those options were not entirely accurate. To ensure fairness, the calorie options presented were carefully chosen so that the average of the five options always matched the specific calorie count given to the group with detailed information. The researchers measured the total number of calories participants logged over the three days.

The second study shifted to the realm of intelligence and used an intelligence quotient test. Two hundred and four participants were recruited online through Amazon Mechanical Turk, a platform for online tasks, and received a small payment for their participation. Again, there were two groups: a ‘cheating’ group and a ‘control’ group. All participants took a ten-question intelligence quotient test consisting of multiple-choice questions.

Those in the ‘cheating’ group were given an extra instruction: the correct answer to each question would be highlighted immediately after they answered. This allowed them to easily see the right answers as they went along, and effectively cheat by inflating their score if they chose to simply look at the highlighted answers. The ‘control’ group did not receive this answer highlighting.

After the test, both groups were shown their actual score. Then, they were asked to predict how they would perform on a second intelligence quotient test, where no answer highlighting would be provided for either group. The researchers compared the actual scores on the first test and the predicted scores for the second test between the two groups.

The third study continued to investigate intelligence, but this time using anagrams, which are word puzzles where letters are scrambled. Two hundred participants from Amazon Mechanical Turk participated for a small payment. Similar to the previous studies, there was a ‘cheating’ group and a ‘control’ group. Both groups were given nine anagrams to solve within a three-minute time limit.

The ‘control’ group typed their answers into boxes on the screen. After three minutes, the correct answers were displayed, and the number of correctly solved anagrams was automatically recorded. The ‘cheating’ group, however, did not have answer boxes. They were instructed to solve the anagrams using paper and pencil until the page automatically advanced after three minutes.

On the next page, the correct answers were provided, and participants in the ‘cheating’ group were asked to self-report how many anagrams they had solved correctly. This setup provided an opportunity to cheat by overstating their performance. After the anagram task, all participants were asked to rate how much their performance was due to their intelligence versus the difficulty of the task, and also how much they agreed that anagram solving is an accurate test of intelligence.

The final, fourth study broadened the focus to financial literacy. Two hundred and thirty-three participants from Amazon Mechanical Turk were recruited and paid for their participation. This study used a more complex design, with four groups in total. The design combined the ‘cheating’ versus ‘control’ condition with another factor: whether participants were made to feel uncertain about their financial knowledge before taking a financial literacy test.

To create uncertainty, some participants read a statement highlighting that many people overestimate their financial knowledge. All participants then took a ten-question true or false financial literacy test. In the ‘cheating’ condition, the correct answer to each question appeared on screen after a few seconds, again offering the chance to inflate their score by simply looking at the answer. The ‘control’ group did not receive these answers. After the test, participants rated their own financial literacy by indicating how well terms like “financially intelligent” and “financially smart” described them.

Across all four studies, Dommer uncovered a consistent pattern. In the calorie counting study, participants who did not have specific calorie information logged fewer calories than those who had detailed information. This suggests they were indeed choosing lower calorie options, even when less accurate, to feel healthier.

In the intelligence quotient test study, those in the ‘cheating’ group scored significantly higher on the test compared to the ‘control’ group, as expected. Importantly, the ‘cheating’ group also predicted they would do better on a second intelligence quotient test, even though they knew they would not have access to answers on the second test.

Statistical analysis showed that their inflated performance on the first test directly influenced their optimistic predictions for future performance. This indicates they were deceiving themselves into believing their initial, cheated score reflected their true ability.

“All the evidence of diagnostic self-deception surprised me,” Dommer told PsyPost. “I figured something like this had to be going on, but any time people are blind to their behaviors I am surprised by it. For instance, in Study 2, where those who cheated predicted they would score higher on a subsequent IQ test (compared to the control group) even when they knew they wouldn’t have the answers — crazy!”

Similarly, in the anagram study, participants in the ‘cheating’ group claimed to have solved more anagrams than the ‘control’ group actually did solve. Furthermore, the ‘cheating’ group attributed their performance more to their own intelligence and less to the task’s difficulty, compared to the ‘control’ group. They also rated anagrams as a more valid measure of intelligence. Again, statistical analysis demonstrated that their inflated anagram performance drove these self-serving beliefs about their intelligence and the task’s validity.

The financial literacy study added another layer of understanding. As in the other studies, participants in the ‘cheating’ condition scored higher on the financial literacy test. However, when participants were made to feel uncertain about their financial knowledge beforehand, the effect of cheating was weaker.

Interestingly, those who were made uncertain and could cheat actually performed slightly worse than those who could cheat but were not made uncertain, suggesting that priming uncertainty reduced their motivation to cheat. Participants in the ‘cheating’ condition generally rated themselves as more financially literate.

While the uncertainty prime did not significantly reduce this boost in self-perceived financial literacy, the overall pattern suggested that feeling uncertain made people less likely to enhance their self-perception through cheating. Statistical analysis further supported the idea that cheating on the financial literacy test led to enhanced performance, which in turn boosted their self-perception of being financially literate, especially when they were not made to feel uncertain.

“It is one thing to cheat a crossword puzzle and feel smarter,” Dommer said. “I doubt that is doing much harm. But these illusory self-beliefs can still be harmful, especially when assessing your financial or physical health. When a person engages in diagnostic self-deception, they may underuse products and services designed to help them. This is why it’s important to be aware of illusory beliefs and strive to seek accurate self-assessments.”

These studies, while insightful, do have some limitations. “Most of my studies look at ‘cheating’ in the aggregate,” Dommer noted. “For instance, the average score for those given answers is higher than the average score for those without answers. So, I cannot definitely say whether people cheated or not.”

“Still, the data tells a story. In Study 2, participants completed 10 questions from an IQ test. In the control condition (where they did not have the answers), no one scored a perfect (10/10). The max score was 9, scored by only 5% of participants in this group. In the cheating condition (where they had access to the answers), 43% scored 10/10 and 29% scored 9/10.”

Looking ahead, researchers could explore who is most prone to this type of self-deceptive cheating. For instance, individuals who are already inclined to see themselves in a positive light might be more likely to cheat to reinforce that positive self-view. Future studies could also investigate factors that might reduce this kind of cheating, such as promoting mindfulness, encouraging self-affirmation, or even increasing mental workload.

The study, “Acting Immorally to Self-Enhance: The Role of Diagnostic Self-Deception,” was authored by Sara Loughran Dommer.